Depreciation percentage on equipment

Land is not depreciable property. So if the straight-line depreciation rate is calculated to be 10 percent the 150 percent depreciation is found by dividing the straight-line depreciation percentage by 15 150.

Depreciation Rate For Plant Furniture And Machinery

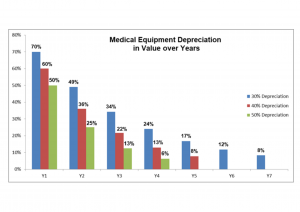

The Modified Accelerated Cost Recovery System MACRS allows you to take a bigger deduction for depreciation on medical equipment for the early years in the life of an.

. Calculation based on double declining method. Not Book Value Scrap value. The residual value is zero.

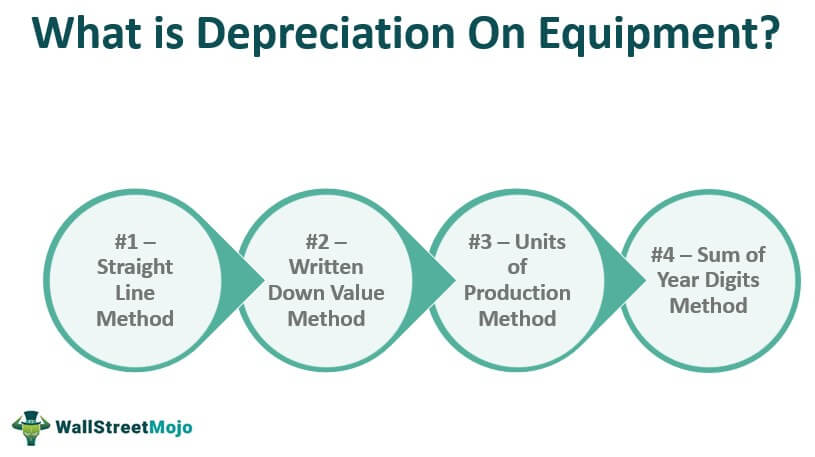

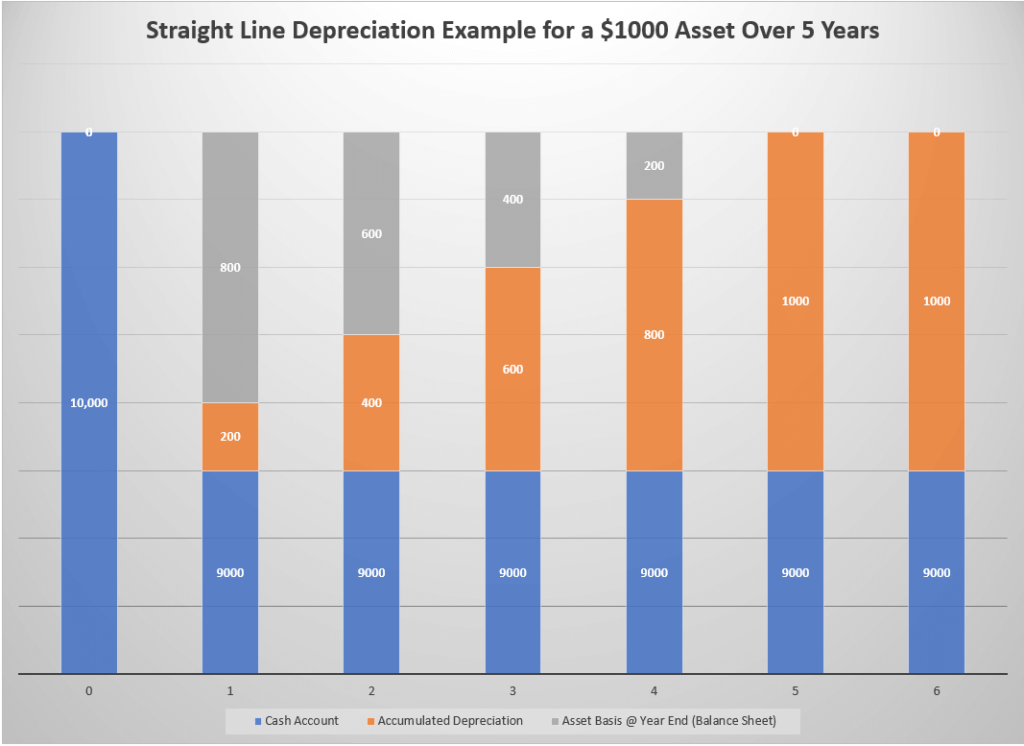

It takes the straight line declining balance or sum of the year digits method. The formula to calculate depreciation through the double-declining method is. Depreciation is a term used with reference to property plant and equipment PPE whereas amortisation is used with reference to intangible assets.

When an asset loses value by. 170 rows Class of assets. Percentage Declining Balance Depreciation Calculator.

The following calculator is for depreciation calculation in accounting. There are various methods to calculate depreciation one of the most commonly used methods is the. Calculates the office equipment depreciation for the computers as below.

When an asset loses value by an annual percentage it is known as Declining Balance Depreciation. Calculate his annual depreciation expense for the year ended 2019. Depreciation is a term used with reference to property plant and equipment PPE whereas amortisation is used with reference to intangible assets.

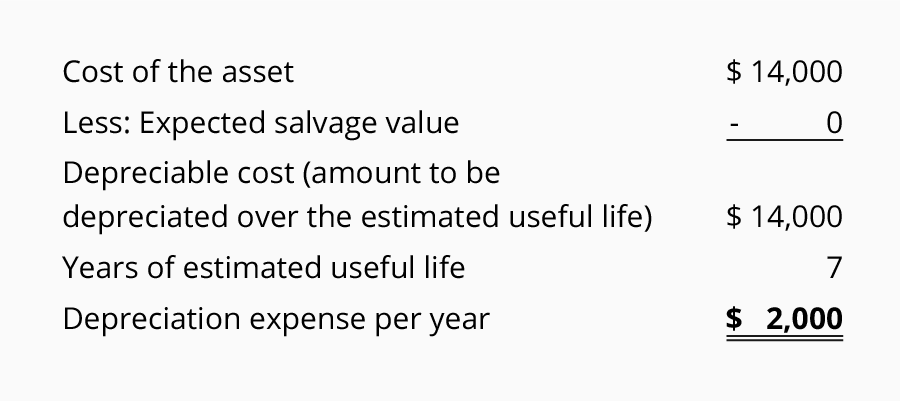

Depreciation Office equipment cost Office equipment salvage value Useful life. Depreciation Expense Cost Salvage value Useful life. Tax software will make this calculation automatically as the tax return is preparedTable A-1 above provides percentages to calculate the annual depreciation over a.

Ali also bought a computer system at a total cost of 10000 on 1 st January 2019. Enter on line 9923 in Area F the. Annual Depreciation rate Cost of Asset Net Scrap Value Useful Life.

If you are using the double declining. Depreciation allowance as percentage of actual cost a Plant and Machinery in generating stations including plant foundations i Hydro-electric34 ii Steam. For example if you have an asset.

Therefore when you acquire property only include the cost related to the building in Area A and Area C. Consider a piece of equipment that costs 25000 with an estimated useful life of 8 years and a 0. Ali has a policy of.

Depreciation Schedule Formula And Calculator Excel Template

Cash Flow Line By Line Long Term Assets Youtube

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

Why Is Accumulated Depreciation A Credit Balance

An Update On Depreciation Rates For The Canadian Productivity Accounts

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense

Straight Line Depreciation Accountingcoach

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

:max_bytes(150000):strip_icc():gifv()/Term-Definitions_depreciation_FINAL-c4437bbc37bf455588e59e1eb11dd299.png)

Aivzow7nyvg9im

Depreciation Rate Formula Examples How To Calculate

Depreciation On Equipment Definition Calculation Examples

An Update On Depreciation Rates For The Canadian Productivity Accounts

What Is Equipment Depreciation And How To Calculate It

Depreciation By Fixed Percentage Youtube

Used Medical Equipment Valuation How Much Should You Pay